Gross up paycheck calculator

28429 x 02965 8429 total tax withheld 28429 8429 200 net bonus As you can see in the. Gross pay calculator Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be.

Gross Up Payroll Calculator Paycheck What If For Microsoft Dynamics Gp

Also we encourage anyone to contact our payroll tax specialists if you have further queries or would like to explore options with PayTech.

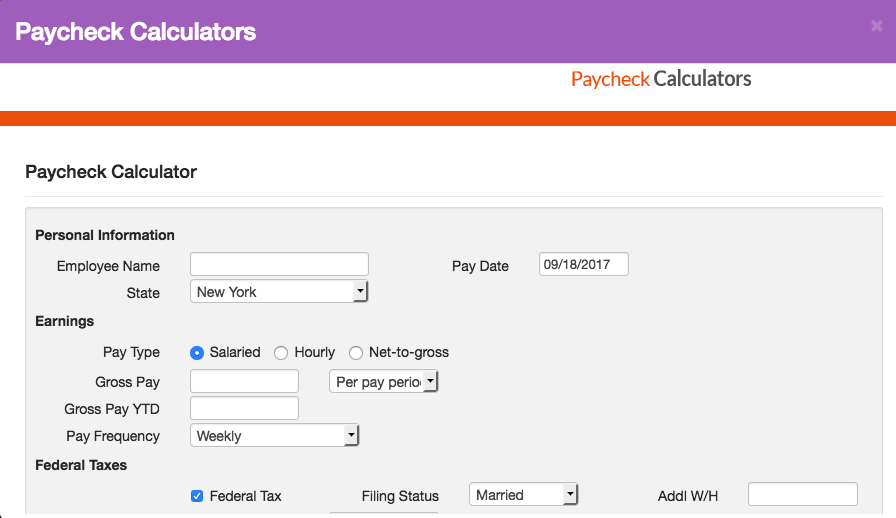

. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. First enter the net paycheck you require. Back to Previous Page.

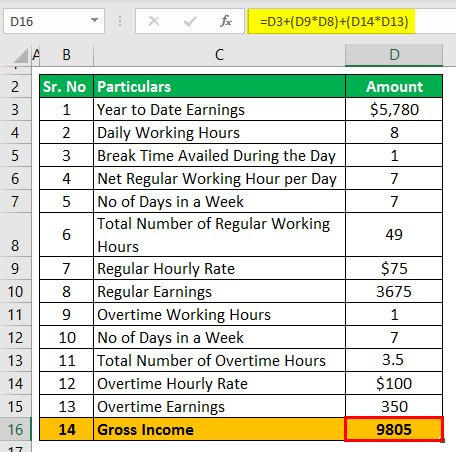

If youre needing to determine. Gross-Up Calculator Calculate your gross wages prior to the withholding of taxes and deductions. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Form W4 Form W4 Wizard Fill out a Form W4 federal withholding form with a step-by-step wizard. Primepoint is a human resource management and payroll processing company offering technology that integrates human. For example if an employee earns.

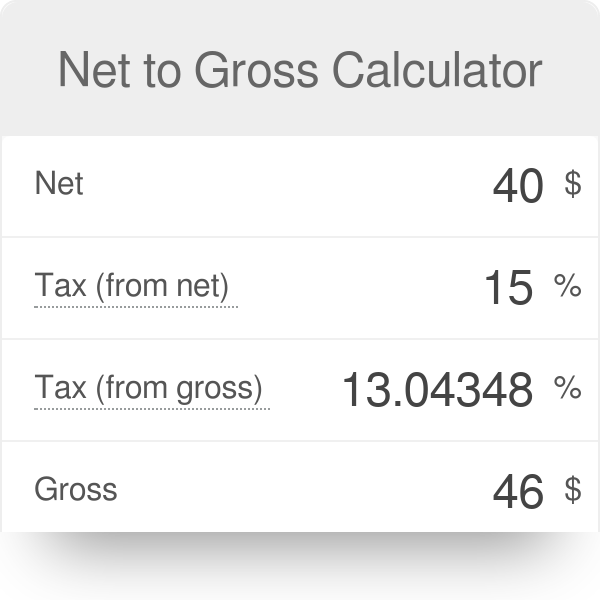

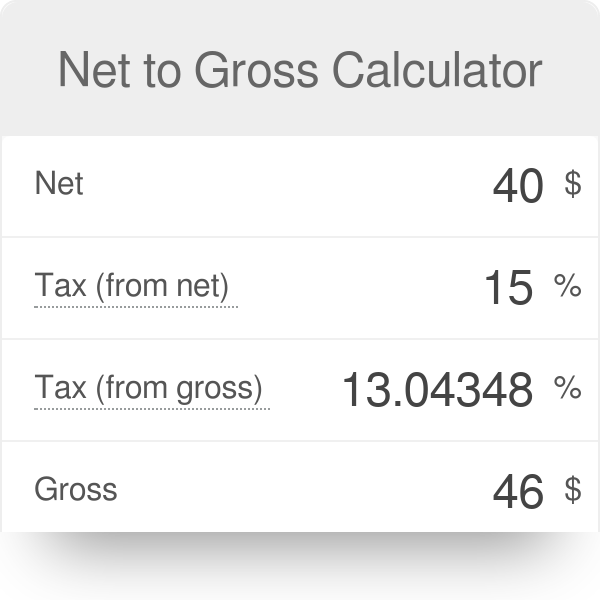

Federal Income-- --State Income-. Youll just need a few things including your net or take-home pay amount. Net To Gross Paycheck Calculator This calculator helps you determine the gross paycheck needed to provide a required net amount.

The payroll calculators that are provided on this website are only meant. Gross-Up Calculator Calculate the gross wages based on a net pay amount. To enter your time card times for a payroll related calculation use this.

How to calculate annual income. As a result Janes gross. Home Gross-up Paycheck.

Gross-Up Calculator Illinois Illinois Gross-Up Calculator Change state Use this Illinois gross pay calculator to gross up wages based on net pay. The results are broken up into three sections. 200 07035 28429 gross payment Check your calculation.

For example if an employee receives 500 in. The Gross-Up Payroll Calculator can easily determine gross pay by entering take-home pay and any deductions. We offer affordable accurate and accommodating Payroll Serivce online including tools like paycheck calculator payroll calendar and tax organizer saving time and money.

Gross Paycheck --Taxes-- --Details. Paycheck Results is your gross pay and specific. Gross Up Calculator - MMC HR is a Human Resources Outsourcing and Payroll Services in Los Angeles California.

You work backward to come up with the gross-to-net pay calculation and divide 5000 by 75. Federal Gross-Up Calculator Results Below are your federal gross-up paycheck results. Calculator Use Calculate gross pay before taxes based on hours worked and rate of pay per hour including overtime.

To remedy the situation you can gross up Janes bonus check.

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Gross Up Payroll Calculator Paycheck What If For Microsoft Dynamics Gp

How To Gross Up A Net Value Check

Gross Up Payroll Calculator Paycheck What If For Microsoft Dynamics Gp

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Net To Gross Calculator

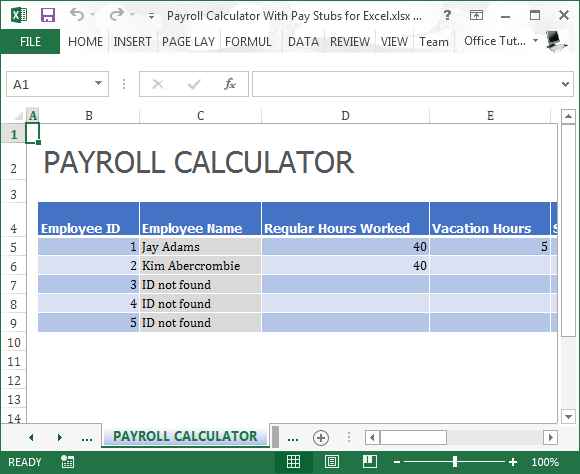

Payroll Calculator Free Employee Payroll Template For Excel

Paycheck Calculator Apo Bookkeeping

Hourly Paycheck Calculator Step By Step With Examples

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Gross Pay And Net Pay What S The Difference Paycheckcity

Payroll Calculator With Pay Stubs For Excel

Net Pay Calc Deals 50 Off Www Wtashows Com

Paycheck Calculator Online For Per Pay Period Create W 4

Gross Up Payroll Calculator Paycheck What If For Microsoft Dynamics Gp

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Amazon Ca Appstore For Android

How To Calculate Net Pay Step By Step Example